Aspiring homeowners reading confusing (and often conflicting) media headlines may find themselves frustrated with real estate market updates, sales, price and interest rate statistics when all they really want to know is how to afford a house in Toronto in 2018. What are the household income requirements to keep home ownership dreams alive and buy a house in Toronto?

When estimating affordability, the first rule, as set out by the CMCH, is that your monthly housing costs (mortgage principal and interest, taxes and heating expenses) should not exceed 32% of your gross household monthly income. For condos, PITH also includes half of your monthly condo fees.

CMHC’s second rule of affordability is that your monthly debt load, including housing costs, should not be more than 40% of your gross monthly income (think credit cards, car payments, loans etc.)

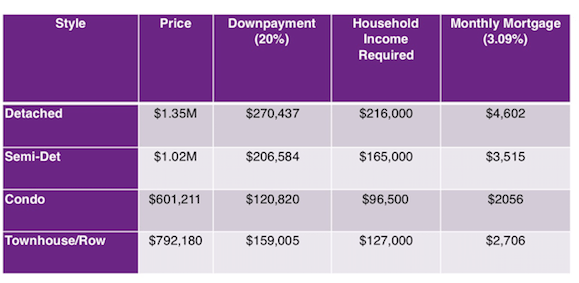

The following table is a broad, simplified chart that was made to help aspiring homeowners match income levels to home prices and give buyers a realistic picture of what they can afford.

Individual numbers will change based on their amount of down payment, interest rate, amortization period, personal debts, etc. For calculation purposes, we assumed a 5-year fixed interest rate of 3.09% (lowest I could find!), a downpayment of 20% (savings and/or parental assistance) and an amortization period of 30 years.

A more detailed, circumstance-specific calculator is available here, where individuals can input personal details about their current financial situation and arrive at a more accurate figure.

April 2018 Avg Toronto Home Prices

Homeownership challenges like a 6-figure income, tightened lending rules and staggering home prices can leave would-be buyers feeling overwhelmed, discouraged, priced out of the market and wondering how to afford a house in Toronto.

Some key things to consider:

- Properties BELOW average selling prices are available, just be prepared to act quickly.

- Homes with rental income can assist with lender qualification and the mortgage payment. Think about co-buying with friends.

- Be flexible with your location, buy in one of Toronto’s Top 5 Affordable neighbourhoods, described here.

- Start with a condo purchase first; build equity in your first home while working towards your dream home.

- Consider a less than “move-in-ready” property and renovate over time.

- Compromise on “must-haves” while house-hunting, maybe the kids can share a room if it gets you in the right neighbourhood within budget.

Interested in learning more about How to Buy a House in Toronto? Feel free to contact me for our free (and no obligation), Comprehensive Step-by-Step Guide to Buying a House in Toronto.

Want to know more about how buying works and how to afford a house in Toronto? I’d love to help. Contact me anytime. No pressure, no pushy sales talk. Just the answers you need.

Eliza says:

Hey Pal

I think I’ll contact you very soon. You said very well “should not be more than 40% of your gross monthly income” I have never calculated this way. All the time I applied for loan never get positive approval, may be my salary is the big reason of not getting positive approval. I am glad that I found your post. This is really very helpful for me.