- Budgeting For Your Future

- Mortgages 101 – What You Need to Know

- Define Your Team

- Finding a Home You Love

- Making an Offer

- Your Offer is Accepted! Now What?

- Closing Day

- Managing Post-Purchase Expectations

- Considering Buying a House in Toronto?

1. Budgeting For Your Future

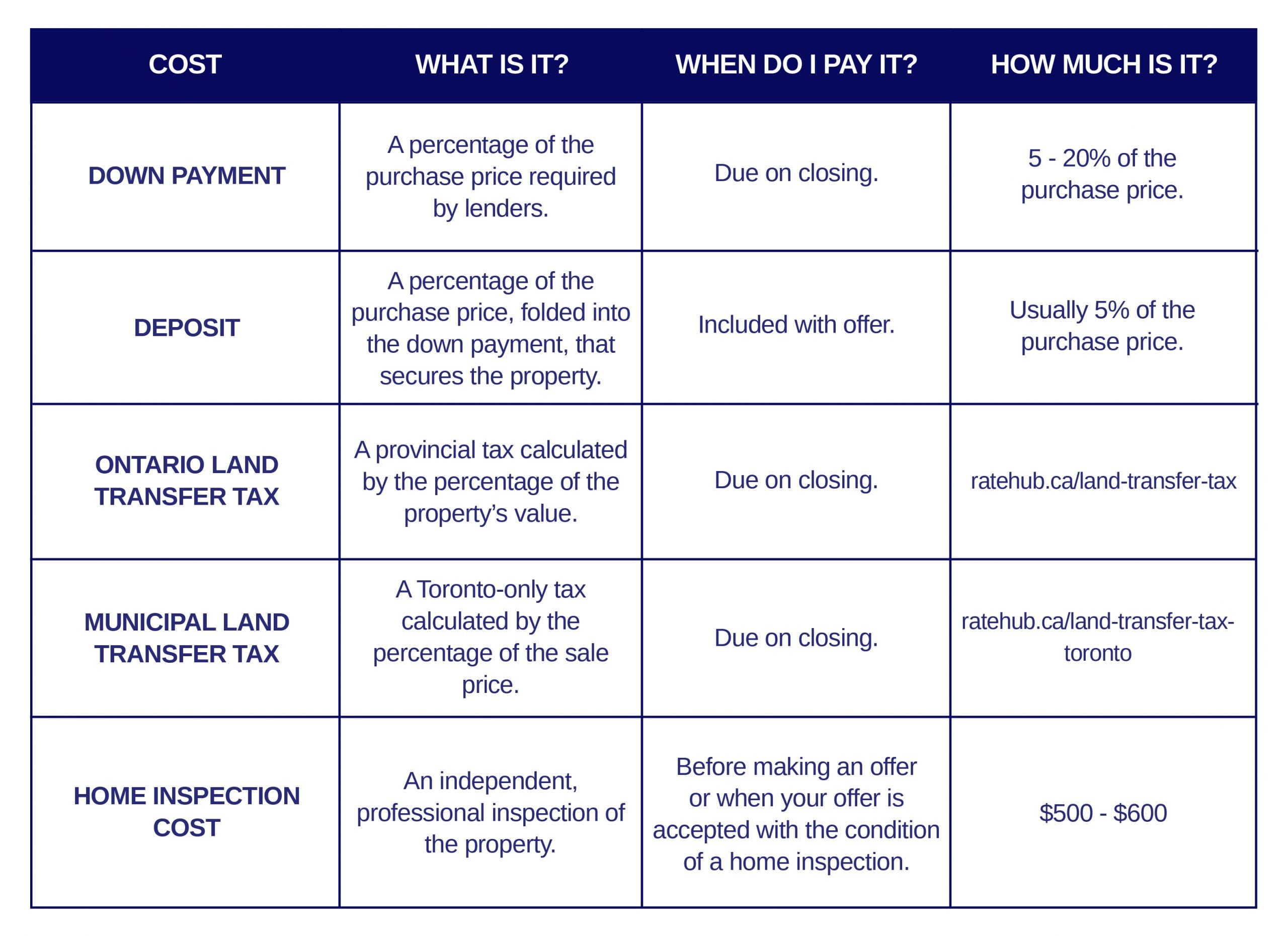

1a) Initial Costs

Initial costs are the fees that you need to be prepared to pay throughout the home buying process. They include things like your down payment, deposit, land transfer tax, home inspection report(s), and more. Don’t get caught off guard – preparing for initial costs is key to reducing financial stress during the process of buying a house.

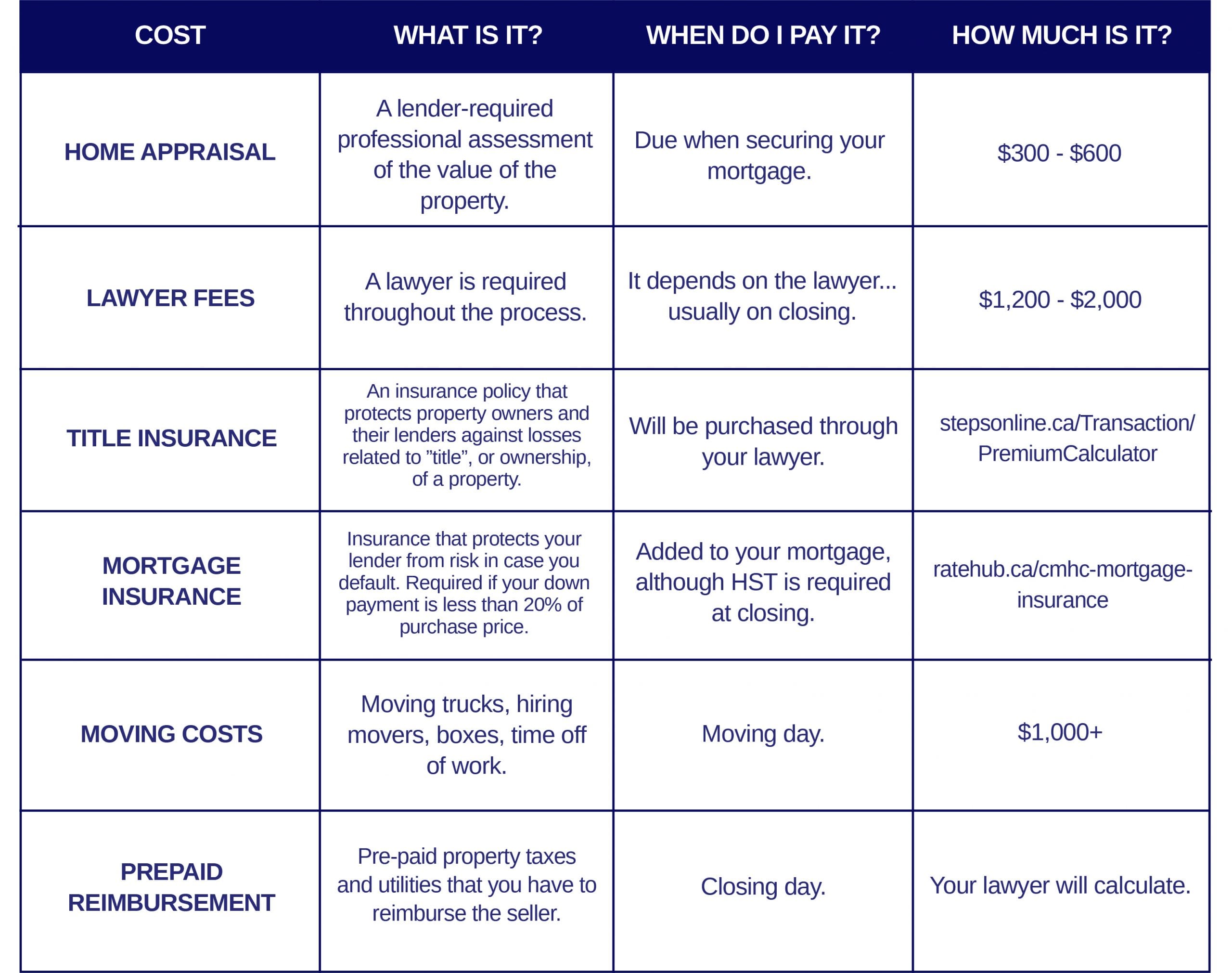

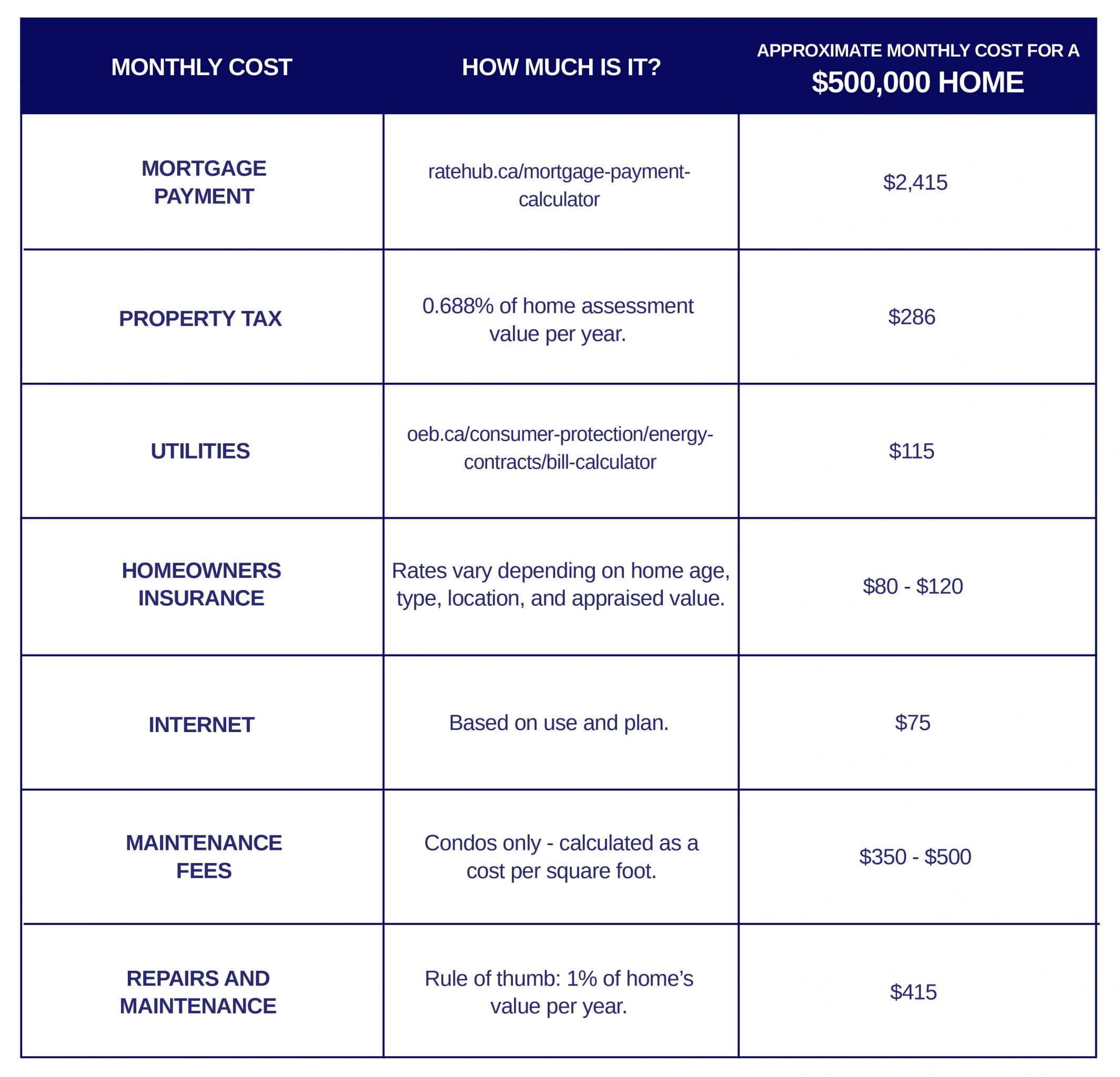

1b) On-Going Costs

The finances of buying a house include the ongoing costs of “carrying” that home. It’s important to calculate these costs and compare them to your current monthly income so you can budget accordingly.

2. MORTGAGES 101: WHAT YOU NEED TO KNOW

2a) MORTGAGE BASICS

VARIABLE VS. FIXED

Variable rate mortgages are attached to the prime rate and can change over time. The upside of this risk is that variable rates are typically lower than fixed rates.

How do you decide?

If your financial snapshot shows that you could handle an interest rate hike over time, then variable is probably the way to go. But if you’re on a tight budget or looking for a home at your max budget, then a fixed rate is the safer option.

OPEN VS. CLOSED MORTGAGES

Open mortgages give homeowners the ability to pay off their mortgage at any time without penalty. The downside of open mortgages is that the interest rate is higher.

Closed mortgages have a penalty if you pay off the mortgage before your term ends, but generally have a lower interest rate. The penalty for breaking a closed mortgage is the Interest Rate Differential, or three months’ interest, based on your current mortgage balance, whichever is higher.

AMORTIZATION PERIOD

Your amortization period is the length of time within which you agree to pay off your mortgage, usually 25 years. In Canada, the maximum amount is 35 years. That amount is reduced to 25 years if the mortgage is CMHC insured.

PAYMENT SCHEDULE

Surprisingly, not all mortgages are paid monthly. Some mortgage payments are weekly or bi-weekly, but the most popular schedules are monthly. There are also pre-payment options which allow you to increase your monthly payment and/or make a lump sum payment against the principal.

2b) DOWN PAYMENT

Does Your Down Payment Have to Be 20%?

Homes that cost more than $500,000 require a 10% down payment. Buyers purchasing homes that cost less than $500,000 can put down 5%. Homes that cost more than $1 million require 20% down.

2c) MORTGAGE INSURANCE

How Does Mortgage Insurance Work?

Mortgage insurance protects your lender – not you – from risk associated with mortgage default. It is mandatory for down payments under 19.99%. Mortgage insurance costs between 2.8% – 4% of your mortgage amount. In general, the smaller your down payment, the higher your mortgage insurance premium. You can pay them up front or have them folded into your mortgage.

2d) CREDIT SCORE

What’s Your Credit Score?

Lenders want to assess how risky it might be to lend you money. A score below 600 is considered risky. A score above 700 is good.

Factors that influence your credit score:

- Payment history – missed payments and delinquencies

- Number of outstanding debts and balances

- Credit account history

- Number of recent inquiries for new credit

It is always a good idea to obtain a copy of your credit report to make sure there aren’t any mistakes or surprises.

2e) GET PRE-APPROVED FOR A MORTGAGE

What is Mortgage Pre-Qualification? – A financial snapshot

Pre-qualification helps you understand what you can afford based on your current financial situation.

Mortgage brokers who offer pre-qualification services will review your income, debt, assets, credit history, available savings, and estimated closing costs to confirm the amount and type of loan you’re eligible for. They may provide you with a pre-qualification letter.

It’s important to note that it’s an approximation of what you can afford and what a financial institution might lend you. It doesn’t always take into account your credit report or other important documentation.

What is Mortgage Pre-Approval? – An agreed upon interest rate

Mortgage pre-approval is when a lender agrees to fund your mortgage based on your financial situation – but it’s not a guarantee. Still, it’s better to get pre-approved when buying a house.

You’ll submit a loan application which will include proof of employment, current salary, position, and length of time with the organization, savings, debts, and credit reports.

The mortgage broker will tell you the maximum you can afford to spend on a home, your estimated monthly mortgage payments, and the interest rate the lenders are willing to offer.

The mortgage broker can put a “rate lock” on the interest rate offered, which is valid between 30 to 120 days. You will be given a pre-approval letter that outlines the terms and conditions.

It’s important to note that mortgage pre-approval is not a guarantee that the lender will grant you a mortgage for that amount. The approval of the mortgage depends on the purchase price and the appraised value of the home.

2f) HOME BUYER PROGRAMS

First-Time Home Buyers’ (FTHB) Tax Credit

The FTHB Tax Credit offers a $5,000 non-refundable income tax credit amount on a qualifying home acquired after January 27, 2009. For an eligible individual, the credit will provide up to $750 in federal tax relief. You can claim this $750 amount on your personal income tax return on line 369.

Land Transfer Tax Rebate

You can get a rebate on your provincial and municipal land transfer tax as a first-time home buyer. The provincial rebate is a percentage of the purchase price, which is 0.5% on the first $55,000, and increasing incrementally to 2% for anything over $400,000. The Toronto rebate uses a similar structure. Your lawyer will be able to claim these rebates electronically.

HST New Housing Rebate

New construction home buyers (homes purchased from a builder) may be eligible to claim a provincial new housing rebate for some of the provincial part of the HST that you paid when buying a house.

You qualify for this rebate if you bought a new or substantially renovated house (including a new condominium unit) and you meet the following conditions:

- the house is located in Ontario and is for use as your, or your relation’s, primary place of residence; and

- you are eligible to claim an HST new housing rebate for the house or share, or you would be eligible if the purchase price or fair market value was less than the maximum threshold for claiming that rebate. This means that a provincial new housing rebate may be available even if an HST new housing rebate for some of the federal part of the HST is not available.

The maximum Ontario new housing rebate amount that is available is $24,000.

The guide and application info can be found here.

Home Buyers’ Plan: RRSP Withdrawals

First-time home buyers can withdraw funds from their RRSP in order to pay for their first home. The amount withdrawn can’t exceed $35,000. You have to fill out Form T1036 in order to be eligible to withdraw. There’s a 2-year grace period before you have to start paying back the RRSP.

CMHC Refund

Energy efficient homes (or energy-saving renovations) are eligible for a 25% refund of their mortgage loan insurance premium.

3. DEFINE YOUR REAL ESTATE TEAM

3a) CHOOSING A REAL ESTATE AGENT

How Do Commissions Work?

Commissions are based on a percentage of the property sale price, paid by the seller to the listing broker. The broker then divides the commission between the agents involved in the transaction, including the buyer’s agent.

A typical commission is 5% of the sale price. On a $500,000 home, that’s a $25,000 commission.

The $25,000 is split in half between the buyers’ and sellers’ agents; $12,500 each.

Then, the $12,500 fee is divided, with portions going to team members, brokerage fees, professional fees & insurance, administrative & marketing staff, overhead, and marketing costs incurred during the sale like professional photography, staging, cleaning, and more.

Buyer’s Representation Agreement

The Buyer’s Representation Agreement is a contract that formalizes the relationship between you, the buyer, and your agent’s brokerage.

It is a legal agreement that means the agent will work exclusively for you for a specific amount of time (usually 6 months).

It guarantees you a fiduciary duty of care and loyalty from your agent, who agrees to put your best interests before all else.

It also outlines the expectations of your relationship, the property type you’re looking for, your agent’s commission structure, and gives you complete access to your agent’s working knowledge of the market.

You’re not legally required to sign a BRA. In fact, you don’t always have to sign one in order to have an agent represent you. But without the BRA, you may find yourself underrepresented, or with your interests being a lower priority in a transaction.

DON’T BUY WITH THE LISTING AGENT

Sometimes, if a buyer comes across a property they love, they might be inclined to hire the listing agent to represent them. We don’t recommend this – how can your agent truly represent your best interests in a sale if they represent the best interests of the seller? It’s an ethical quandary at best. Don’t sell yourself short. Always choose an independent agent.

3b) CHOOSING A MORTGAGE BROKER

Mortgage brokers connect lenders with borrowers. They are specialists who can find the right mortgage for you and negotiate a better rate. A great broker will give you a number of options, while outlining the pros and cons.

3c) CHOOSING A LAWYER

The search for your real estate lawyer should happen at the same time as you’re selecting your real estate agent and mortgage broker. You want plenty of time to find a good attorney!

“Residential attorneys” specialize in home sales and spend 100% of their time handling residential real estate transactions. Don’t forget to ask about their fees, as lawyer fees can vary

PROFESSIONALS, ASSEMBLE

It might come as a surprise that you’ll need to assemble a team beyond your agent, lawyer, and mortgage broker throughout the process of buying a house. You may also have to connect with:

An Insurance Broker

A Home Inspector

An Appraiser

A Land Surveyor

Builders and Contractors

An Environmental Specialist

4. FINDING A HOME YOU LOVE

4a) DEFINE YOUR PRIORITIES

We use a system to narrow down our clients’ wants and needs when buying a house: Must-Haves, Nice-to-Haves, and Not-a-Big-Deal.

Location, Lifestyle, and Needs

In addition to the specific features you’re looking for inside your next home, there’s another important consideration when buying a house: lifestyle and location. Where, and how, do you want to live?

Living in the central core of the city provides opportunities for community living, walking and biking to most errands, and easy access to work or school, as well as restaurants, parks, and cafes right outside your door. And transit opportunities galore!

Central core living usually comes with less space, more noise, less privacy, and a higher price. Living outside of the core gives you more inside and outside space at a lower price, but may come with a greater distance to work and fewer walk-bike-transit options.

What Kind of Home Suits Your Needs?

This is the ultimate question when buying a house. Do you need a chef’s kitchen with ample storage for all your cooking equipment? Do you need more closet space to accommodate your love of shopping? How about a home office, a playroom for the kids, or an extra bathroom? How long do you plan on living there?

Once you’ve outlined your priorities, the things that matter less might fall into place: maybe you need a backyard, but you’re not so picky when it comes to detached, townhouse, or semi-detached.

Not sure what you need? Take your time. Start by keeping notes about the features of your current living space that aren’t working for you and of features that you do like as you visit properties of interest with your real estate agent.

For example, we had a client, a couple in their mid-fifties, living in a detached house in the west end. As avid foodies who love Toronto’s restaurant scene, they were looking to downsize to a condo unit closer to a bustling west end strip. They realized, after making their wants and needs list, that they hadn’t considered the amount of time they would spend waiting for elevators. With a small dog, an active lifestyle, and a long-term outlook, this could become a problem.

We found them the perfect unit on the second floor of a new condo building. They could choose to take the stairs or wait for the elevator, solving the problem while still getting exactly what they wanted.

Let’s make sure your next home works for you.

4b) WHAT TO LOOK FOR WHEN VIEWING A HOUSE

- Can you picture yourself living here?

- Is the neighbourhood established or gentrifying?

- Is it on a quiet, tree-lined street?

- Does it have the right amenities for you? – Schools, Parks, Community centre/daycare, Skating rinks, Swimming pool, Restaurants, Cafes, Shopping, Grocery stores, TTC/Transit

- How many kilometres is it to: Your workplace? Kids’ schools?

- How is the home heated?

- Is there a pre-list home inspection?

- Does it have a rental suite or potential for one?

- Does it have a separate entrance?

- Is the ceiling tall enough?

5. READY TO MAKE AN OFFER

5 a) WHAT GOES INTO AN OFFER?

An official offer is submitted as an Agreement of Purchase and Sale and is drafted by the Buyer’s Agent. It’s a written contract that outlines your proposed purchase. It will include:

- Your name

- The seller’s name

- The property address

- Items in the home you want to be included in the purchase (chattels and fixtures**)

- Financial details

- Closing date

- The date and time the offer expires

- Conditions, if any (home inspection and/or financing)

- Amount of deposit (certified cheque or bank draft)

- Other terms, i.e vacant possession or additional deposit or repairs to be completed before closing.

Once you’ve discussed and agreed to a strategy with your agent, its time to pull the trigger. Your real estate agent will draft your offer, explain it, and prepare it for your signature before presenting it to the seller. They will either accept, reject, submit a counter-offer, or ask you to improve it.

What’s the difference between a “chattel” and a “fixture”? A real estate lawyer once explained chattels to me like this: Pick up a house, turn it upside down, and shake it. Everything that falls out is a chattel. Everything that stays is a fixture. Easy!

5b) WHAT’S AN OFFER DATE? WHAT DOES IT MEAN WHEN A SELLER “HOLDS BACK” OFFERS?

The offer date is the day when the seller agrees to review all offers. In Toronto, this matters because many properties receive multiple offers, and an offer date guarantees a fair review of each of them.

A “bully offer”, or pre-emptive bid when buying a house, is an earnest, firm (condition-free) offer made before the offer date that is only valid for a couple of hours. It is intended to persuade the seller to forgo the offer date.

5c) NAVIGATING A MULTIPLE-OFFER SCENARIO

Prior to offer night, your agent will contact the listing agent’s broker to find out how many registered (signed) offers there are on the property. While the contents of the other offers are confidential, it will give you an idea of how much competition you have.

In a multiple-offer scenario, there is little room to negotiate with the sellers, and depending on the listing agent’s strategy, you may not be given another opportunity to improve your offer. That’s why putting in a strong, competitive, condition-free offer the first time is imperative. You don’t want to lose your dream home because you offered too low, included a condition or had the wrong closing date.

6. YOUR OFFER HAS BEEN ACCEPTED! NOW WHAT?

6a) YOUR DEPOSIT IS REQUIRED WITHIN 24 HOURS

Your certified cheque or bank draft needs to be provided within 24 hours if it wasn’t included with your offer. It will be held in trust by the listing broker until closing process.

6b) SECURE YOUR FINANCING

You need to secure your mortgage in order to actually pay for the home. Your lender will need:

- The Agreement of Purchase and Sale

- Proof of income

- Debts

- Assets

- Credit history

- The MLS listing

- Appraisal

- Proof of homeowners insurance

If your mortgage application is approved, congratulations!

6c) YOUR LENDER WILL SCHEDULE AN APPRAISAL

Your lender will likely require an appraisal. If it’s been appraised at a lower value than what you’ve agreed to pay, then you will have to make up the difference.

6d) GET HOMEOWNERS INSURANCE WITHIN 2 WEEKS

Your lender wants to ensure that their collateral – your home – is safe and sound. They will require homeowners insurance, which varies depending on your home’s location and appraised value. Torontonians purchasing a $500,000 – $1,000,000 home can budget for about $1,000 per year for home insurance.

What about repairs? You may be able to fold renovations and repairs into your mortgage. Talk to your lender about your loan options.

6e) TALK TO YOUR LAWYER

Your lawyer will assemble all required documents including a statement of adjustments, the deed to the property, the mortgage commitment, and a current property tax assessment. They will also conduct a property title search, purchase title insurance on your behalf, confirm fulfillment of the conditions, and ensure your finances are confirmed with your lender.

It’s a lot – and that’s why they are an integral part of your team!

6f) GET YOUR BUYER’S STATEMENT OF ADJUSTMENTS BEFORE CLOSING DAY

The Statement of Adjustments will be prepared by your lawyer and will include the amount you owe the seller on closing day. Your lawyer will prepare this document and walk you through it.

7. CLOSING DAY

7a) CONGRATULATIONS!

Closing day is the day!

You’ll do a final walkthrough of the property to ensure everything is in order. During the walkthrough, you’ll note whether the fixtures and chattels are in place, according to your agreement, and will make sure all the appliances work.

You’ll also hand over your Statement of Adjustments cheque. The seller will sign over the deed and hand over the keys. Your lawyer will register the new deed on your behalf and that completes the process of buying a house. Congratulations – you’re a homeowner!

7b) WHAT CAN GO WRONG?

Closing day can be stressful because things can go wrong.

Sometimes buyers are unable to secure financing, or sellers haven’t removed their items from the property. Fixtures or furnaces can break down during the closing window.

When these things happen, it’s important to stay calm and defer to the professionals. Your real estate agent, attorney, or lender will help you work through the issues.

At first, buying a house can be fun. Choosing and touring potential homes is exciting. But over time, the realities sink in: Securing financing, dealing with less-than-ideal circumstances, and losing out on properties can really drag you down. “Positive psychologists”, who study the science of happiness, have found that managing stress boils down to enjoying the process. Yes, there are let-downs and stressful situations in real estate. But remind yourself that, in the end, it will all be worth it.

8. MANAGING POST-PURCHASE EXPECTATIONS

8a) SAFETY AND SECURITY

You never know who had access to your new home, whether it’s previous tenants, owners, relatives, or neighbours. Change your locks within the first month of moving in.

Do a thorough review of your smoke alarms and carbon monoxide detectors and replace them if they’re old.

File all of your documents where they’re easily accessible. I can’t tell you how many homeowners lose their paperwork in the move! In the event that you do, don’t worry, both your real estate agent and your lender have copies.

8b) DEALING WITH BUYER’S REMORSE

In red-hot markets like Toronto when buying a house, sometimes buyers can get caught up in the frenzy of Offer Night. The end result can sometimes be buyer’s remorse.

There are a few ways to deal with it. First, stop looking at other properties online. This seems to be the number one indicator of buyer’s remorse. Other properties all show their best face with top-notch professional photos, video tours, and more. Just like the house you now own, those houses have their own quirks, and their eventual buyer will no doubt find something they don’t like about it.

The best way to deal with buyer’s remorse is to remember that it’s not forever. Most people live in their homes for less than ten years; even less for their first home. Use this house as a stepping stone to find your dream home if this one isn’t quite “it”. At the very least you now have a fantastic idea of what you want next time around!

9. CONSIDER BUYING A HOUSE IN TORONTO?

Are you ready to jump into the Toronto real estate market? Want to know a little more about how buying a house works in the city? Need some help taking the stress out of buying a house?

I’d love to help. Contact me any time.

No pressure, no pushy sales talk. Just the answers you need.

Sohag Mahmud says:

nice post it is

Ollie Oakley says:

You have covered everything there is to know about buying a house in Toronto. I don’t live in Canada but I’ve got a friend who’s interested in getting a property in the area. This post is very helpful and informative. I’ll be sure to have my friend read this.

Thanks!

Alex Beauregard says:

Thanks Oliver!

Paige Peyton says:

Great article!

This is a great resource for anyone who’s interested in buying a house in Toronto. I totally agree with everything that you mentioned here especially the parts about the initial and on-going costs. After all, those two should always be on top of your anyone’s list when purchasing a house.

Jacob Lopez says:

Good information! This post is very helpful and informative.

Thanks Again

rachel frampton says:

My husband and I would like to move to Toronto this year, which is why we’re currently looking for a house where we can stay. Well, I agree with you that it would be best if we’ll compare the costs to our current monthly income. Thank you for also informing us that an open mortgage will allow us to pay without penalty.

Alex Beauregard says:

Thanks for the comment Rachel, and glad you found the information helpful. Feel free to contact me directly if you have any additional questions, or need help with your search.